Hi everyone! Last week followed the pattern of what has been a summer full of... well, almost everything besides new, exciting frugal accomplishments. Our short little Michigan summer is packed full of social events, with a few special trips scattered here and there. It's the prime time for gardening, not to mention the fact that most of Hubs' work happens during the warmer months. So, summer is not the best time to start new, exciting house projects or keep detailed track of things like how much we're spending on toilet paper. While I have kept receipts in my purse for the past few months, I've been a terrible record keeper when it comes to different spending categories.

2018 is also my first summer with a baby in tow. I love being a mama, but doing things with the baby on my back, front, or by my side takes quite a bit longer. You can still get stuff done; it just gets interrupted every 15 minutes with some need or distraction. Even getting ready in the morning takes longer, because I'm getting her ready as well.

Even though I don't have anything fresh to share with you this week, I thought I'd write down a few things that I usually leave out of my list. The following tidbits are too mundane and boring to write about every week but are still great ways to save money.

1. Grocery shopping. Some weeks I'm super organized and come home with manager's specials, coupon freebies and sale items galore. Other weeks I take the easy route and do a Walmart grocery pickup. Both ways are frugal. The pickup order saves at least an hour of shopping time for me, plus Walmart's regular prices are (mostly) the same as Kroger's sale prices for things like meat or frozen vegetables. On the other hand, it's so easy to get free coupon deals with Kroger's digital coupon system. First, find a good couponing Youtube channel and spend five minutes watching a video every week. I watch the video on my computer, with the app open on my phone, to download coupons right away, so I don't forget. Then I watch the video again and physically write down the deals that I like on a piece of paper. So, I've spent 10 minutes (5 minutes if there are no good deals), plus an additional 5 minutes at the store looking for each free item. The time commitment may or may not be worth it to you.

2. Gardening. Every week I try to harvest some things or work out in the garden. If I'm honest, I've been a terrible gardener lately. Most of my garden time (about an hour per day) has been poured into weeding the large strawberry patch I planted to support my hobby farm activities. Even so, I've still been able to harvest a little this year; some raspberries here, cucumbers there, a head of lettuce or a bouquet of flowers now and then. For the amount of time and money (about $30.00, plus an average of 30 minutes per week, spread out over the spring and summer), I think gardening is still worth it. Just harvesting a few dollars' worth of products each week will make the investment pay off. Because I have an organic garden, it makes the produce even more valuable to me. Every year, some plants are worth their weight in gold and others are a complete waste. But overall, it works out.

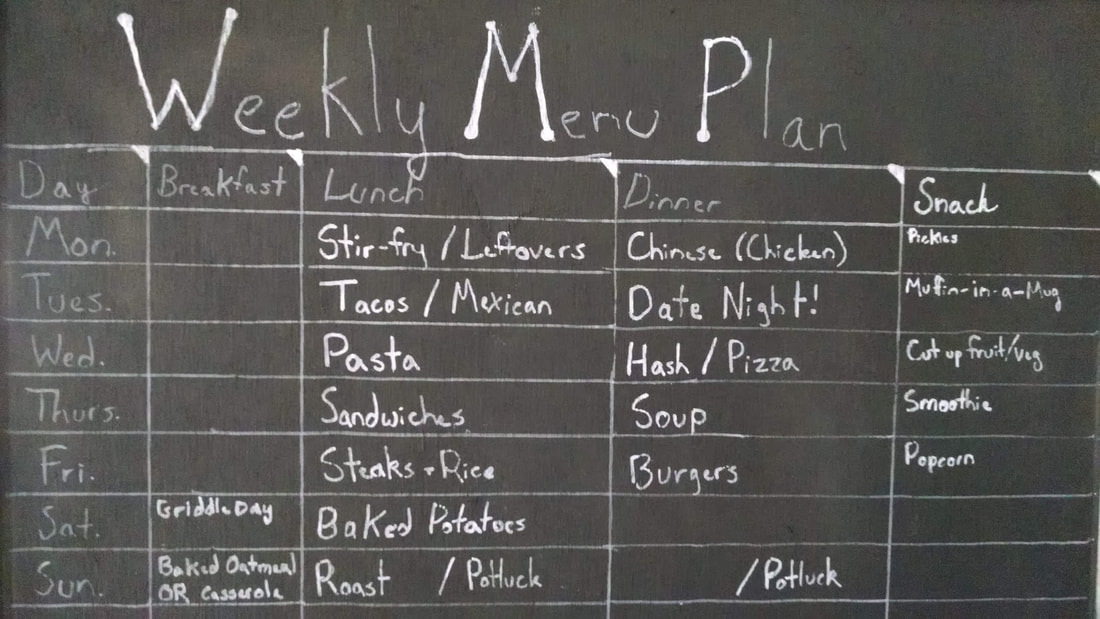

3. Menu planning. I have a permanent menu plan (based on the one in my book, The Housewife's Guide to Menu Planning) written out on the inside of a cupboard door. I sprayed the door with chalkboard paint, then wrote the menu with a chalkboard marker. The chart has been so, so helpful for having meals ready, and ready on time. I've also tacked an ethnicity/culinary region onto each day, in case I'm feeling adventurous. For example, Monday is stir-fry day, but it's also Chinese day. So if I'm feeling lazy, I can throw together a stir-fry. If I'm feeling adventurous or have a little more time to cook, I can make something else that's Chinese- crab rangoons, for example, or General Tso's chicken. Have I ever made those things? No. But I've eaten them at the local Chinese buffet, and they're pretty tasty. Maybe someday.

4. Going for bike rides. We finally got a bike seat and helmet for Baby so that I can go on bike rides again! Biking is frugal because it's free exercise and entertainment. Exercise is a great way to prevent cancer, heart disease, type 2 diabetes, stroke, dementia, and depression, among many other diseases and ailments. Riding a bike is one of those frugal things that makes sense in so many ways... like drinking water instead of pop, or not watching TV. Most of us would be better off doing it, regardless of how much money we have. Also, in some states, you can recycle cans that you find beside the road for money. During the last four years, I've consistently earned $40.00-$80.00 per year by collecting cans on regular walks and bike rides.

5. Using cloth diapers. First off, I want to say that cloth diapers can be a real money pit if done wrong (for example, if you stop buying Parent's Choice disposable diapers and buy a whole stash of brand new BumGenius reusable diapers... when your baby is already a year old). I feel like the estimated savings of cloth diapers are way overblown when compared to cheaper disposable brands like Luvs. That being said, once you find a laundry routine and diapering system that works for you, cloth becomes an easy way to save a few extra dollars per week. I'm currently saving about $25.00 per month on diapers (after the cost of extra laundry detergent and the occasional replacement diaper purchase). I spend less than an hour per week on laundering and stuffing diapers, so for the $5.00 savings it's still worth doing.

6. Air-drying clothes. This saves about $0.75 per load. $0.75 times 52 weeks in a year is a $39.00 savings. I do about 2.5 loads per week, so we're on track to save $97.50 this year! Also, air drying also helps prolong the life of the clothes.

7. Breastfeeding. Yes, this also takes time out of my day. And time out of my nights. But guess what? It's FREE food for Baby! That's a whole lot cheaper than formula, raw milk, goat's milk, or anything else I could buy for our baby. Plus, it's 100% healthy and perfect for our little dear. She's almost a year old now, so by my estimations we've saved about $1500.00 so far. I think I'll just keep doing it for as long as she cares to, because again... it's free. Plus it burns extra calories, and I still have about 5 lbs. of baby weight to lose. I think one of the best investments any mom-to-be can make is to find a good breastfeeding book at a thrift store and read the thing cover-to-cover. Once or twice before the baby is born, and then probably another couple times after baby arrives (in fits and starts, as needed). Anything by Le Leche League should be accurate and reliable. Regarding money saving priorities for new moms, this should be number one.

8. Free stuff. When we visited my sister last weekend, she gave me some hand-me-up clothes. Hand-me-ups are like hand-me-downs, but instead of being passed on to someone who is younger, the stuff is passed on to someone who is older. I'm pretty sure this is a great way to stay youthfully fashionable. Especially if you're someone like me, who has approximately zero fashion bones in my body.

Accepting free stuff is a good frugal habit to practice. If you're like me, though, you're a little too good at accepting free stuff and have to practice saying "no" now and then. If I have an excess of free stuff, I like to pass on the love to another person who might be able to benefit. Decluttering is also a frugal thing to do, because it frees up time and space that would otherwise devoted to caring for, moving around and storing "stuff" that doesn't get used.

I hope you enjoyed reading about my mundane weekly frugal tasks! What are some everyday, non-glamorous things you do to save money?

Til next time,

-Bethany

RSS Feed

RSS Feed